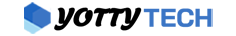

Track the status of your second stimulus check online As with the first stimulus, the IRS is offering an online tool that lets you know when your share of the $900 billion coronavirus relief package will be paid.

Americans who qualify for the $600 second stimulus package can check the status of their payments now at the IRS Get My Payment portal. Even if you are not eligible to receive the full amount of the stimulus package, you can still check the status of your payment.

The IRS launched its Get My Payment webpage in the spring to help people keep track of upcoming payment cycles. By filling out a simple form, you can see the status of any stimulus checks you plan to receive.

Whether you want to receive your check in the mail or have set up a direct deposit to your bank account, the "Get My Payment" app should help you answer a few questions. The IRS stimulus check phone number is also available.

Note: Unless exempt, you must have filed your 2018 or 2019 taxes before the IRS can send you relief money.

Learn how to track your Second Stimulus check status now using the IRS Get My Payment online tool.

The IRS Get My Payment portal is very easy to use, but you will need some information before you can begin using it. Keep a copy of your most recent tax return nearby, if you have one.

Also, to avoid stimulus scams and other identity theft, always check the website URL before entering your personal information; the Get My Payment website URL should look like this: https://www.irs.gov/coronavirus/get-my-payment.

Step 1: IRS Go to the Get My Payment app website; click on "Get My Payment" to enter the portal.

Step 2: After reviewing the terms and conditions, click "OK" on the Permission to Use Notification page.

Step 3: Enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), date of birth (MM/DD/YYYYY), address, and zip code Click "Continue.

You should now see a page that either shows the status of your stimulus payment or that the status is unavailable.

According to the stimulus FAQ, you may see "Payment Status Not Available" if you need to file a tax return but have not yet done so, if you need to file a tax return but have not yet been processed by the IRS, or if you are not eligible.

If you have recently filed a tax return, please be patient and double-check your status on the Get My Payment app. If you have received payment for your tax return but still receive a "Payment Status Not Available" message, call 800-919-9835 and use the Economic Impact Payment information line.

Looking for more financial resources? Learn how to apply for unemployment online.

Comments