I was eligible for a third stimulus check, but as someone who was fortunate enough to have kept up with bills and expenses throughout the pandemic, I decided to put some of my newfound funds into the stock market.

By part, I mean half; the remaining $700 deposited in my bank account went to a local charity.

According to a recent Deutsche Bank survey (via CNBC), I am not the only one who has put some of the treasury payments into an investment portfolio. A majority of respondents aged 18-24 who already have investment accounts said they plan to spend 40% of their stimulus checks on stocks.

However, I am not an existing investor. In fact, I have made a conscious effort to avoid conversations in which the word "stocks" is mentioned, except those involving chicken soup recipes. Stock trading has always seemed complicated, time-consuming, and difficult to approach.

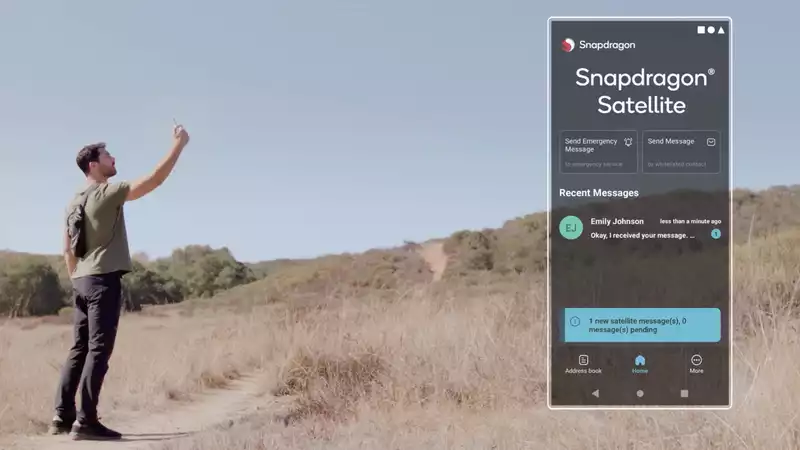

Then, earlier this year, I learned about the Robinhood app. In the wake of GameStop's stock price spike triggered by organized Reddit users, Robinhood was one of several trading platforms that rose to the top of mobile app stores.

Robinhood also locked out controversial stock buys targeted by the r/WallStreetBets thread, infuriating users.

The episode not only marked one of the wildest free trading parties the stock market has ever seen, but also sparked behavioral interest in the stock market among young adults. For the first time, participation in the stock market seemed accessible.

I installed Robinhood and found it to be truly accessible. Opening an account took only a few minutes.

Once I entered my basic information, the app told me that I would not have to pay any commissions or fees to trade stocks or other tradable securities. In addition, it offered me one free share in a scratch-off welcome game.

In fact, Robinhood's app almost completely gamifies trading. You swipe up, apply for a trade, and are greeted with confetti when your purchase is complete. While this obviously has the potential to perpetuate risky trades, it also makes investing on your own less scary.

Of course, I didn't spend all $700 at once on stocks; I used the Robinhood app and tracked the value of my top stocks through the app's list. The list organizes groups of stocks and allows him to see daily trends at a glance.

In fact, choosing which stocks to invest in is already complicated: when I think about companies I spend money on, or just know a lot about, I default to the tech sector.

However, I avoid supporting these companies through my personal investments because I write news and reviews of products manufactured by these companies. Instead, I am optimistic that the travel industry will recover as more people get vaccinated. I am also optimistic about the success of companies that manufacture vaccines.

Could I be off the mark? Yes, I do. I'm in my first day of trading, so you definitely don't want to take market advice from me. However, I do know what it's like to feel mentally alienated from investing in stocks. If you start your portfolio with a stimulus check, you might get a chance to learn something new and make $700 more.

If you're still waiting for your stimulus check, check out our Stimulus Check Tracking Guide. It also explains how stimulus checks work for children.

Comments